The Price of Wonder: Decoding Graphene’s Cost and Its Journey to Your Everyday Life

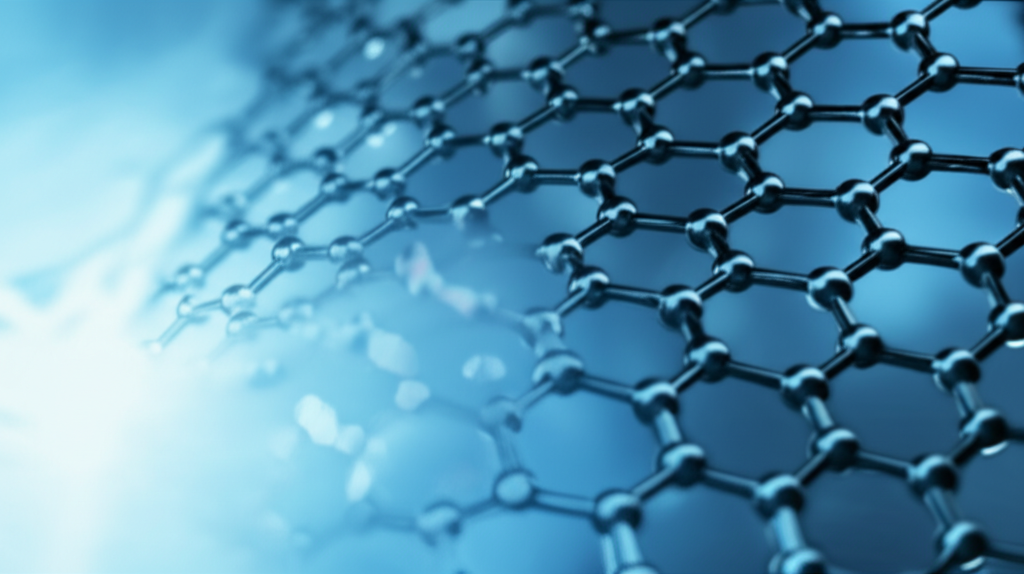

Imagine holding in your hand a material that’s demonstrably stronger than steel, gossamer-thin, and possesses the uncanny ability to conduct electricity with almost zero resistance. This isn’t science fiction; it’s graphene. A single layer of carbon atoms arranged in a hexagonal lattice, graphene has captivated scientists and engineers with its dazzling array of “wonder properties.” But if it’s so miraculous, why aren’t our lives already saturated with it? The answer, as always, dances around the complexities of cost.

Join me as we delve into the economic labyrinth of graphene. We’ll trace its path from an exorbitantly priced novelty to a material on the cusp of affordability, exploring the factors that dictate its price and the innovations paving the way for its widespread adoption.

Graphene’s Grand Entrance: A Trip Down Memory Lane

The birth of graphene is steeped in delightful serendipity. Its “discovery,” if you can call it that, involved the mundane act of using Scotch tape to peel layers from graphite – yes, the very same graphite in your pencils. This ingenious yet simple “Scotch tape method” earned Andre Geim and Konstantin Novoselov the Nobel Prize in Physics in 2010. However, in its nascent stages, graphene was the exclusive domain of research labs, commanding prices that reached into the tens of thousands of dollars for a piece the size of a postage stamp. It was a true science fiction material, tantalizingly out of reach.

Thankfully, the story doesn’t end there. The expiration of early patents ushered in a “Graphene Spring,” democratizing production knowledge and opening the field to a flurry of innovation. Massive research initiatives, such as the Graphene Flagship, have played a pivotal role in scaling up production and driving down costs.

The Graphene Shopping List: What’s on the Menu Today?

Here’s where the plot thickens. “Graphene” isn’t a monolithic entity; it comes in various “flavors,” each with its unique characteristics, applications, and, most importantly, price.

We have Graphene Oxide (GO), a chemically modified form, and its reduced counterpart, Reduced Graphene Oxide (rGO). Then there’s Few-Layer Graphene (FLG), CVD Graphene Films, Graphene Nanoplatelets (GNPs), and the intriguing Turbostratic Graphene.

Currently, you’ll find Industrial GO at a budget-friendly $50/kg in bulk. GNPs are also becoming quite affordable at $50-$75/kg for tonnage. These are your go-to choices for composites and coatings. The workhorses, rGO and FLG, offer more conductivity than GO while remaining relatively accessible, with few-layer rGO hovering around $50-$150/kg. The high-tech superstars, CVD Graphene Films and monolayer graphene, command a premium, ranging from $1,000-$10,000/kg (or even $200/cm² for films), finding applications in cutting-edge electronics and high-performance batteries.

The question, of course, is why such a vast range? Purity and perfection are paramount; the cleaner and more single-layered the graphene, the steeper the price. The form factor matters too: powder, dispersion, or pristine film, each presents unique production challenges. Production methods also heavily influence cost, with Chemical Vapor Deposition (CVD) being a more elaborate and expensive process compared to liquid-phase exfoliation. Lastly, quantity plays a role; buying in bulk invariably lowers the unit cost.

Who’s snapping up all this graphene? A diverse range of industries, including electronics, energy storage (batteries, supercapacitors), composites (aerospace, automotive), coatings, and even tire manufacturers. Each application demands specific “grades” of graphene, further fragmenting the market.

The Wild West: Challenges & Hurdles

The path to widespread graphene adoption isn’t without its bumps. The lack of standardized definitions creates an “identity crisis,” making it difficult to compare products and navigate the market. Ensuring consistent, high-quality material at scale remains a significant “quality control conundrum.” Furthermore, integrating graphene into existing manufacturing processes without incurring exorbitant costs or compromising product integrity presents “integration headaches.” Separating realistic applications from over-enthusiastic claims is another challenge. Finally, geopolitical factors, such as dependence on specific regions (like China) for graphite, introduce supply chain vulnerabilities.

Graphene’s Crystal Ball: A Cheaper, Brighter Future?

Despite these challenges, the future looks promising. Prices are projected to continue their downward trajectory, with an estimated 12% annual reduction for powder/platelet materials until 2028.

Innovation is accelerating the process, with methods like Flash Joule Heating transforming plastic waste or coal into graphene, drastically reducing raw material costs. Advances in liquid-phase exfoliation, electrochemical exfoliation, and new “one-pot” processes are streamlining manufacturing. Even CVD is becoming more economical with the use of inexpensive copper foils as substrates.

As demand surges, economies of scale will kick in, further driving down unit costs. The market is projected to reach up to $6.9 billion by 2034, and some analysts predict graphene could achieve price parity with lithium (around $11/kg) by the mid-2030s for battery applications.

Turbostratic Graphene is also emerging as a game-changer, offering “monolayer-like” electronic properties even in multiple layers, making high performance more accessible and robust. Furthermore, easily dispersed forms of graphene are simplifying integration into various products like composites and coatings. Giants like NanoXplore, First Graphene, Graphenea, and Versarien are scaling up and innovating, securing long-term contracts and solidifying their positions as major suppliers.

Value-based pricing strategies justify premium prices for cutting-edge applications, while penetration pricing aims to rapidly gain market share for industrial-grade materials. Cost-plus pricing provides a foundational approach, ensuring producers cover their ever-decreasing costs.

Where to Grab Your Graphene: The Sales Channels

For researchers and those simply curious, platforms like eBay and Amazon offer small quantities of graphene powder and graphene-enhanced products. For industrial powerhouses, B2B direct supply contracts offer custom solutions and technical support, while specialized distributors bridge the gap, providing local support, currency options, and streamlined logistics.

Conclusion: Graphene’s Bright, Affordable Horizon

Graphene’s journey from an outrageously expensive scientific marvel to a rapidly commercializing material is a testament to human ingenuity and relentless pursuit of innovation. Its future is less a question of “if” and more a matter of “when” it becomes ubiquitous, fueled by relentless innovation and steadily declining costs. What exciting new products or technologies do you envision graphene revolutionizing next, now that it’s becoming increasingly accessible? The possibilities, it seems, are as limitless as the potential of this extraordinary material itself.