Graphene Nanoplatelet Prices in 2025: A Market Snapshot (USA vs. India)

Introduction

Graphene nanoplatelets (GNPs) are ultra-thin stacks of graphene sheets, prized for their exceptional strength, electrical/thermal conductivity, and large surface area. In 2025, GNPs are transitioning from research novelty to industrial material, with prices dropping significantly as production scales up . This report provides a comprehensive look at current GNP pricing in the United States and India, segmented by grade and application. We also profile key market players, discuss recent pricing trends, and offer an outlook for late 2025 into 2026. The goal is to help readers understand how GNP costs vary by quality and use-case, and what factors drive regional price differences in these two important markets.

GNP Grades and Pricing by Quality (2025)

Graphene nanoplatelets come in different grades, largely defined by layer count (thickness), surface area, and purity. Fewer-layer graphene (e.g. <5 layers thick) has higher surface area and performance, whereas multi-layer graphene (10+ layers) is more akin to fine graphite. These differences translate to notable price variations:

• Industrial-Grade (Multi-Layer) GNPs: Bulk “industrial” GNPs have more layers (thicker stacks), more structural defects, and lower specific surface area. They are the most affordable form. In 2025, U.S. suppliers offer industrial-grade GNP powder for around $50–$75 per kg when purchased in tonnage quantities . This grade is often used for polymer composites, coatings, and other applications where large volume at low cost is key. In India, domestic suppliers list similar multi-layer graphene powders at roughly ₹5,000–₹10,000 per kg, which is approximately $60–$120 . (Indian pricing can vary based on import costs and smaller batch sizes, but is in the same order of magnitude.) Small-quantity purchases are far less economical – for example, buying just a few grams can cost about $15 per 100 grams (industrial grade) in the U.S., which equates to $150/kg at lab scale .

• Research-Grade (Few-Layer) GNPs: “Few-layer” graphene nanoplatelets (often <5–10 layers thick) feature higher purity and surface area, thus commanding a premium. In bulk, high-quality GNPs in 2025 are priced around $65–$90 per kg in the U.S. for commercial volumes . However, at small scales their price skyrockets: research labs might pay $35–$40 per gram (tens of thousands of dollars per kg) for small bottles of few-layer GNPs . In India, few-layer GNPs are not yet produced at large scale – many must be imported – leading to higher local prices. Some Indian vendors sell 50-gram packs of high-purity GNPs for about ₹4,000–₹5,000 (₹80–₹100 per gram) , translating to well over $1,000 per kg. This highlights the price gap for advanced grades in India. Notably, researchers in India are working on ultra-low-cost production methods: one lab reported making graphene for as little as $30 per kg (₹2,000) on a pilot basis . While not yet commercial, such breakthroughs hint at future cost reduction in the region.

• Functionalized GNPs: Both markets also offer functionalized graphene nanoplatelets – GNPs with chemical groups (e.g. carboxyl, amine) attached to improve dispersion or bonding. Functionalization typically adds a 20–50% price premium over the base material due to extra processing . For example, U.S. suppliers sell oxidized or amine-functional GNPs in small quantities at $0.50–$1.00 per gram more than non-functionalized grades . In India, functionalized GNPs are available through niche providers, but often on a custom order basis; their pricing similarly runs higher than standard GNPs (and may involve import costs if sourced abroad).

Table 1. Representative Bulk Pricing of Graphene Nanoplatelets by Grade (2025)

GNP Grade & Quality USA Bulk Price (USD) India Bulk Price (INR)

Industrial / Multi-layer (thicker stacks, lower surface area) $50–$75 per kg (ton-scale orders) ~₹5,000–₹10,000 per kg (domestic supply; ~$60–$120)

Research / Few-layer (thin <5 layers, high surface area) $65–$90 per kg (bulk orders) ($35–$40 per gram at lab scale) Typically >₹10,000 per kg for comparable quality (limited local production)Lab-scale costs can exceed ₹80,000/kg

CVD Monolayer Graphene (single-layer films) $1,000–$10,000+ per kg (specialty product) Rarely produced domestically; imported price similarly high (used only in R&D)

Pricing notes: The above ranges assume bulk purchases. Smaller quantities command much higher unit prices, as seen with research-grade GNPs . Prices also depend on purity and defect levels – ultra-pure or tightly size-specified nanoplatelets may cost more. Currency conversions use 2025 rates (₹1 ≈ $0.012). Overall, U.S. and Indian bulk prices for standard GNP grades are in the same ballpark, though India faces higher costs for the most advanced materials due to import reliance and lower domestic volume.

Market Segmentation by Application

GNPs are used across a wide array of industries, and the type of application often dictates which grade of graphene is needed – and thus the price range. In global terms, composites are currently the largest application segment for graphene nanoplatelets, accounting for roughly one-third of demand by revenue . In 2023, composites comprised about 31.5% of the GNP market, as manufacturers in aerospace, automotive, and construction incorporate GNPs into plastics, carbon fiber, and resins to boost strength and conductivity . Because composites can typically utilize multi-layer (industrial-grade) GNPs, they benefit from the lower end of the price spectrum (~$50–$75/kg) .

Graphene nanoplatelets market growth by application (2020–2030). Composites (purple) have led demand (~31% in 2023), with energy storage (blue) rising quickly. Conductive inks/coatings (green) and others (lavender) also expand as graphene finds diverse uses . The total market is projected to grow rapidly through 2030.

Following composites, energy storage is a high-growth segment. GNPs are being researched and deployed in batteries and supercapacitors to improve electrode performance – boosting energy density and charge rates . Few-layer GNPs or reduced graphene oxide (rGO) are often preferred here for their larger surface area and conductivity. These materials are still relatively affordable in bulk (on the order of $50–$150 per kg) , making graphene-enhanced batteries increasingly viable. The energy sector’s share of GNP usage is expected to surge in coming years, driven by demand for clean energy technologies and the need for better battery materials .

Conductive inks and coatings form the next major segment. Graphene nanoplatelets are added to paints, inks, and thin films to impart conductivity or anti-corrosion properties. For example, GNP-based conductive inks enable printed flexible electronics and RFID antennas, while graphene-loaded paints can protect surfaces from rust and chemical exposure. This segment overlaps with electronics and composites – for instance, an anti-static coating on a composite aircraft part. GNPs used in inks and coatings often need good dispersion but not necessarily the absolute highest purity; multi-layer or moderate-grade nanoplatelets can suffice. Prices for GNPs in this segment thus tend to fall in the middle range (tens of dollars per kg). The use of graphene in coatings is gaining traction especially in printed/flexible electronics and corrosion-resistant paints .

Other emerging applications include electronics and biomedical uses. In mainstream electronics (e.g. thermal interface materials, EMI shielding), GNPs enhance performance of components and tend to use higher-grade materials in small amounts. For cutting-edge microelectronics – like semiconductor interconnects or sensor devices – pure monolayer graphene or few-layer films produced by CVD might be required, which are extremely costly (thousands of dollars per kg) . Fortunately, these applications use minute quantities. Biomedical applications (such as drug delivery systems, biosensors, and tissue engineering scaffolds) are another frontier . They currently represent a small portion of the market, as regulatory hurdles and the need for consistent quality limit widespread use. When employed, graphene for biomedical R&D is usually of very high purity (and sold in gram-quantities at high prices). As production techniques improve, even these specialized sectors could see more reasonable pricing.

Table 2. GNP Applications and Typical Price Ranges (2025)

Application Area Common GNP Grade Used Typical GNP Cost (Bulk)

Composites (plastics, rubbers, structural materials) Multi-layer industrial GNPs (5–50 layers) for mechanical reinforcement $50–$75/kg (large-volume)

Coatings & Paints (conductive or barrier coatings) Multi-layer GNPs or graphene oxide for ease of mixing $50–$75/kg (bulk quantities)

Energy Storage (battery electrodes, supercapacitors) Few-layer GNPs / rGO with high surface area for conductivity $50–$150/kg (depending on quality needed)

Conductive Inks & Printed Electronics (antennas, circuits) Few-layer graphene nanoplatelets (good conductivity) $50–$150/kg (mid-range; some applications use premium grades)

Advanced Electronics (microchips, sensors) CVD graphene films, monolayer or near-monolayer graphene $1,000–$10,000/kg (specialized material)

Biomedical & Others (biodevices, filtration, etc.) High-purity graphene (often lab-scale production) Variable; typically high for small batches (tens of $ per gram)

As shown, less demanding, high-volume applications like composites and coatings can utilize cheaper grades of graphene, whereas cutting-edge electronics and biomedical uses require costly high-purity forms. This application-driven demand mix is one reason the average price of GNPs has been steadily decreasing – the fastest-growing segments (composites, energy storage) are those that can leverage economical bulk graphene . Meanwhile, the premium niche applications remain a smaller slice of the market in 2025.

Key Producers and Market Influencers

The graphene nanoplatelet industry in 2025 involves a mix of specialized nanomaterial firms, large chemical companies, and emerging startups. In the United States, several key producers and suppliers have shaped the market:

• XG Sciences, Inc. – A U.S. pioneer in graphene nanoplatelets, known for proprietary production processes. XG Sciences has been a leading supplier (estimated ~20% global market share) and offers various grades of xGnP® nanoplatelets for composites and energy storage .

• NanoXplore, Inc. – A Canada-based company with operations in North America, NanoXplore operates one of the world’s largest graphene powder facilities (~4,000 tons/year capacity). They focus on supplying GNPs for plastics (they even sell graphene-enhanced plastic masterbatches) and are a major driver of low-cost, high-volume graphene availability .

• Global Graphene Group (Angstron Materials) – A U.S.-based integrated graphene company (formed from the merger of Angstron and others). They control graphene production end-to-end and produce GNPs and graphene oxide for uses ranging from batteries to coatings .

• Haydale Graphene Industries – A UK company active in the U.S. and global market. Haydale supplies functionalized nanoplatelets and has collaborated on composite materials (notably with aerospace companies) .

• CVD Equipment Corp. – An American manufacturer of CVD systems, included here as a key enabler: they produce the equipment that can make high-quality graphene. In 2022–2023, CVD Equipment Corp received multi-million orders for production systems aimed at scaling advanced composites and graphene materials . This reflects growing investment in manufacturing capacity for graphene-enhanced products.

• Others: Companies like ACS Materials (U.S.), Graphene Laboratories Inc. (U.S., known for the Graphene Supermarket online store), and Thomas Swan & Co. (UK, with U.S. distribution) are notable suppliers of GNPs . Major chemical corporations (e.g., Cabot, Mitsubishi) have also shown interest in graphene additives, often through partnerships or venture investments rather than in-house production.

In India, the graphene industry is emerging with strong government backing. While India currently produces only a fraction of what world leaders like China do , several organizations are propelling the growth:

• Ad-Nano Technologies – An Indian startup specializing in graphene and nano-materials. Ad-Nano manufactures graphene nanoplatelets and conductive graphene inks, supplying both research institutions and industrial clients. They market “high quality graphene at very cheapest price” in various forms (powders, masterbatches) , positioning themselves as a key domestic source.

• BT Corp (Generique Nano) – A Bangalore-based company and one of India’s top graphene producers. BT Corp has integrated R&D and production facilities for GNPs, graphene oxide, and even graphene-based composite products. They cater to sectors like defense and have been highlighted among India’s top graphene firms .

• National/Academic Initiatives – The India Graphene Engineering & Innovation Centre (IGEIC) in Kerala (established 2022) and the India Innovation Centre for Graphene (IICG) are public-private partnerships aimed at scaling graphene production and applications domestically . These centers work with startups, academic labs, and industry (including heavyweights like Tata Steel and Reliance) to pilot new graphene technologies and reduce import dependence.

• Large Industrial Players: Indian conglomerates are exploring graphene for their own product lines. Tata Steel, for example, has researched graphene-enhanced coatings for steel to improve corrosion resistance . Reliance Industries has shown interest in graphene for energy storage and materials (leveraging its expertise in chemicals and petrochemicals) . Graphite India Ltd., a major graphite electrode producer, is naturally examining graphene as an adjacent business . These big players lend credibility and resources to India’s graphene efforts, even if they are not yet mass-producing nanoplatelets.

• Other Notables: Companies like Graphene Manufacturers India Pvt. Ltd., C6 Energy, Mahavir Carbon and several university spin-offs contribute to the ecosystem . Many of these focus on specific applications – for instance, using graphene in concrete and construction or in filtration membranes – rather than selling large volumes of raw graphene. An interesting figure is Dr. T. Theivasanthi of Tamil Nadu, who garnered attention by claiming a method to supply graphene at “nano-price” of $30/kg , potentially revolutionizing cost structures if scalable.

Market influencers such as the Graphene Council and international collaborations also shape both regions. The Graphene Council (a global industry body) provides standards and market intelligence that help buyers trust graphene material specs. Additionally, the EU’s Graphene Flagship and various U.S. and India government grants have poured funding into R&D, which indirectly lowers costs by improving production tech . We also see distributors (like Cheap Tubes Inc. in the U.S., which operates CTI Materials) making graphene accessible to a wider market by offering online sales and small-quantity packaging . In summary, the landscape includes a mix of dedicated graphene companies and traditional industry giants, all pushing graphene nanoplatelets toward mainstream use.

Notable Pricing Trends (2018–2025)

Graphene’s price trajectory over the past decade has been dramatic. In graphene’s early days (circa 2010), production was limited to labs and patent-protected methods – costs were astronomical, on the order of tens of thousands of dollars for a tiny sample . That era, when graphene was a Nobel-Prize-winning curiosity, is long over. By the late 2010s, multiple startups had scaled up exfoliation techniques (peeling graphene from graphite) and early patents expired, allowing wider competition . A “Graphene Spring” saw dozens of companies enter the market, driving incremental cost reductions each year.

Going into the mid-2020s, prices for graphene nanoplatelets have steadily declined thanks to improvements in manufacturing efficiency and economies of scale. For example, the expiration of certain IP and massive R&D initiatives (like Europe’s Graphene Flagship) led to knowledge-sharing and lower barriers to entry . As a result, bulk graphene powders that cost hundreds of dollars per kilogram in the early 2010s can now be sourced for under $100/kg from large producers . The U.S. market, benefiting from competition between firms like XG Sciences and NanoXplore, has seen industrial-grade GNP prices stabilize in the $50–$100/kg range by 2025 . Indian suppliers, with growing government support, have also entered the fray – whereas India used to import most nanocarbon materials at high cost, now local producers offer graphene at prices competitive with global rates (on the order of ₹7,000–₹10,000 per kg for standard grade) .

One clear trend is price stratification by quality. Lower-grade graphene (thicker, more defects) has become commoditized, with multiple sources driving the price down. Meanwhile, highest-grade graphene (monolayers or pristine few-layers) still commands a premium. However, even that premium is eroding as new techniques emerge. A pertinent example is “flash” graphene – a process developed in recent years where carbon waste (like plastic or biomass) is zapped into graphene in a flash of electricity. Innovations like flash Joule heating can produce graphene in bulk at extremely low costs (potentially just a few dollars per kilogram in raw energy/material costs) . If commercialized, such techniques could flood the market with cheap graphene suitable for composite fillers, further pulling prices down. In India, a novel “PCD technique” (plasma-assisted chemical process) was reported to cut production costs by 80% (down to ~₹40,000 per kg) for graphene suited to mixing into concrete . While ₹40k is still around $500/kg – higher than prices for standard GNP in global markets – the 80% cost reduction is noteworthy, and further refinements could bring costs in line with global lows. Essentially, both Western and Indian researchers are attacking the cost issue from multiple angles.

Another trend is improving cost-per-performance. Manufacturers are not just lowering price; they’re delivering better quality at the same price. Specific surface areas of GNPs are higher than before for equivalent cost, and defect levels are lower, meaning buyers get more bang for the buck in 2025 compared to a few years prior. This has encouraged larger volume orders. Industry analysts note that as graphene quality stabilizes and standards improve, more big-name end-users (in automotive, electronics, energy) feel confident specifying graphene in their products . This growing demand further incentivizes large-scale production, creating a feedback loop of increasing volume and decreasing unit price.

In summary, since 2018 the GNP market has moved from boutique to bulk. Prices have trended downward each year (often by high single-digit or low double-digit percentages annually) . The U.S. has benefited from large suppliers and technology gains, while India has leveraged innovation and government policy to kickstart local supply. By 2025, graphene nanoplatelets are not “cheap” in an absolute sense, but they are orders of magnitude more affordable than a decade ago – putting them within reach of mainstream industrial use.

Forecast and Outlook (Late 2025–2026)

Looking ahead to late 2025 and into 2026, market observers anticipate continued growth in graphene adoption alongside further price normalization. The global graphene nanoplatelets market is on a strong uptrend: one analysis estimated the market grew from $61.9 million in 2024 to about $74.2 million in 2025, and will sustain ~20% annual growth going forward . This growth is fueled by expanding applications (especially in energy storage and composites) and the maturation of supply chains.

On the pricing front, forecasts suggest a gradual but steady decline in average prices for GNPs as production scales. The cost of graphene powder and platelets could decrease by roughly 10–15% per year through the latter 2020s . Analysts project that by 2028, bulk graphene might be nearly half the cost it is in 2025, assuming no major supply bottlenecks . If demand spikes faster (for example, if a breakthrough battery or semiconductor technology requires massive graphene use), there could be temporary price firming or even increases; but currently, supply capacity seems poised to keep up with growing demand. Big producers like NanoXplore and First Graphene Ltd. are scaling plants to multi-thousand-ton outputs, ensuring a competitive, well-supplied market .

Specific forecasts for late 2025/early 2026 see the market continuing its double-digit growth. Industry reports predict the global GNP market to reach around $85–$90 million in 2026 , on its way to over $180+ million by 2030 . Much of this revenue growth comes from volume expansion (more kilograms being sold), rather than price increases. In fact, for many applications the price per kg is expected to drop slightly year-over-year as larger orders become routine. For instance, an automotive company buying graphene for composite parts in 2026 might negotiate a lower price per kg than they would have in 2024, due to higher volumes and more competitors in the market.

One bold long-term prediction is that graphene could approach commodity pricing by the mid-2030s for certain uses. Experts have speculated that for energy storage (batteries), graphene might achieve price parity with some battery metals. A figure of $10–$15 per kg by around 2035 has been cited for bulk graphene used in batteries . While that is still speculative, it signals optimism that graphene’s cost will not be a showstopper for mass adoption. In the nearer term (2025–2026), we won’t see $10/kg yet, but we might see more offerings in the $40–$60/kg range for industrial-grade GNPs as new low-cost production methods come online.

Regionally, the USA is expected to maintain a strong market for high-value graphene applications – things like advanced composites for aerospace, electric vehicle batteries, and 5G/6G electronics. These sectors prioritize quality and reliability, so U.S. graphene producers focusing on consistent, high-grade output will thrive. U.S. demand will also be bolstered by government support for domestic supply chains (e.g. for critical materials in energy and defense). India’s graphene market is forecast to grow even faster percentage-wise (from a small base). IMARC projects the India graphene market (all forms) to rise from around $10 million in 2024 to $138 million by 2033, a ~31% CAGR . This suggests that by 2026, India will still be a smaller market than the U.S. in absolute terms, but its gap will be closing. Indian companies are likely to focus on cost-sensitive, large-volume uses of graphene (such as enhancing construction materials, batteries for the domestic EV push, and affordable electronics). If Indian R&D succeeds in scaling low-cost graphene production (e.g. converting abundant natural graphite resources to graphene efficiently ), India could become a significant low-cost supplier in the Asia-Pacific region.

To summarize the outlook: Late 2025 and 2026 should see broader commercialization and slightly lower prices. Graphene nanoplatelets will increasingly be bought by the ton instead of the kilogram as new projects come online. The USA and India will both benefit from this trend – the U.S. through greater integration of graphene in high-tech manufacturing, and India through local startups turning R&D successes into production. Challenges remain (quality control, standardization, and scaling to truly huge volumes), but the trajectory is set for graphene nanoplatelets to become cheaper and more ubiquitous each year.

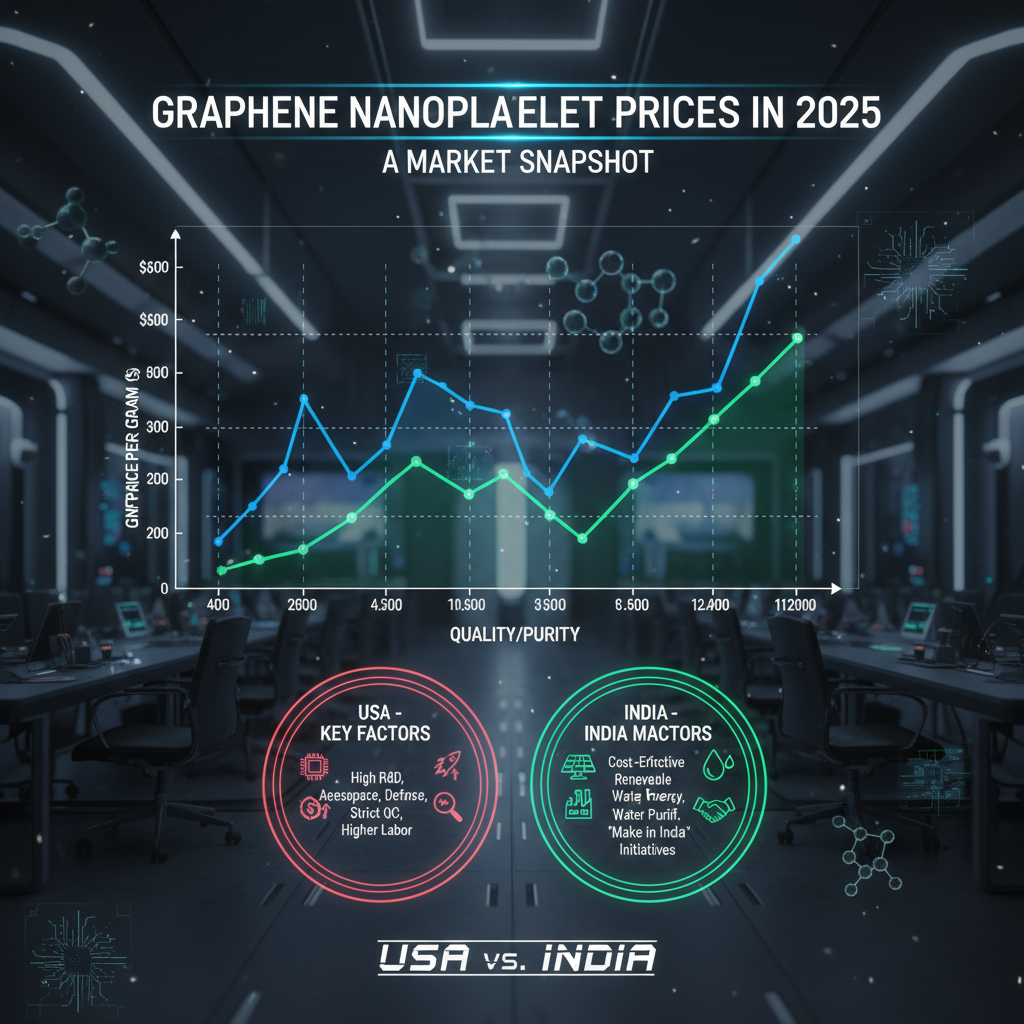

Regional Differences and Drivers: USA vs. India

Despite global trends, local market conditions in the USA and India impart distinct characteristics to GNP pricing and adoption in each country. Below we compare some key drivers and differences:

• Pricing Levels: At bulk order volumes, the base price of graphene nanoplatelets is surprisingly similar between the U.S. and India in 2025. Both see industrial-grade GNP around $60–$100 per kg . The U.S. benefits from multiple competing suppliers and greater economies of scale, which have pushed prices down. India’s nascent industry, while smaller, is aided by lower labor costs and government incentives, allowing domestic suppliers to price competitively (often pegging to global market rates). However, for premium grades, U.S. buyers may get better pricing or availability. A U.S. company can directly source few-layer graphene from a local producer like ACS Materials or Graphene Lab, while an Indian buyer might have to import that material (incurring import duties and shipping). This means Indian customers sometimes pay a markup or face longer lead times for the highest-grade GNPs. As domestic Indian production of high-purity graphene improves, this gap should narrow.

• Demand Profile: In the U.S., demand for GNPs is driven by high-tech and specialty applications: think aerospace composites, advanced batteries (EV and grid storage), defense equipment, and semiconductor/telecom industries. These sectors often require consistent quality and are willing to pay a premium for it. Therefore, U.S. suppliers focus on reliability, certifications, and batch-to-batch consistency, which can slightly increase costs but is necessary for industry acceptance . In India, the demand is more oriented towards cost-sensitive, high-volume uses. A significant push is in areas like construction (cement/concrete additives), energy storage for mass-market batteries, and conductive materials for affordable electronics. For example, Indian researchers have demonstrated graphene’s use in strengthening concrete and aim to use very cheap graphene to make “super concrete” for infrastructure . In such applications, the ability to hit a low price per kg is crucial for adoption (since you might add several kilograms of GNP to a ton of concrete mix, for instance). Thus, Indian suppliers and institutes emphasize lowering cost – even if the graphene is lower grade – to open these large markets. The U.S., conversely, might focus on maximizing performance where only a small amount of graphene is used (e.g. a few hundred grams in a battery or aircraft part), so unit cost is less of an impediment.

• Supply Chain & Infrastructure: The United States has a relatively robust nanomaterials supply chain and infrastructure. Companies can readily source high-quality graphite feedstock (or even synthetic graphite) and have access to advanced equipment. The presence of contract manufacturers and toll processors means U.S. graphene firms can scale more readily when demand spikes. India is rapidly building its infrastructure – the establishment of the India Innovation Centre for Graphene (IICG) in Kochi and related centers is providing pilot-scale facilities and characterization labs to local startups . Nonetheless, India historically had to import high-grade graphite and specialized equipment, which could inflate costs. There is also a skills gap that India is closing through training and collaborations (including international partnerships with the UK and EU) . Over time, as India’s supply chain matures, we expect greater self-sufficiency, which should bring down the cost of production and thus market prices in India.

• Policy and Incentives: Government policy strongly influences the graphene markets in both countries. The U.S. government, through agencies like the Department of Energy (DOE) and Department of Defense (DOD), has funded graphene research projects and even early procurement in areas like battery technology and composite armor. This helps create a stable initial market and signals confidence in graphene, indirectly supporting scale and price reduction. India’s government is even more directly involved in kickstarting the graphene sector – funding research chairs, facilitating joint ventures (e.g., a public-private partnership with Tata Steel for graphene center), and exploring graphene use in national initiatives (such as smart cities and renewable energy). Moreover, India’s “Make in India” ethos encourages reducing import dependence for advanced materials. There have been discussions about tariff reductions or subsidies for graphene production equipment import, which would help local manufacturers. These policy-driven efforts mean Indian companies might enjoy cost advantages in the future (through tax breaks or grants), potentially allowing them to undercut global prices in certain segments.

In essence, the USA’s graphene market in 2025 is characterized by higher-end demand and a competitive, innovation-driven supply base, whereas India’s market is defined by its early-stage growth with an emphasis on affordability and scalability. For buyers in the U.S., this translates to relatively easy access to a range of graphene products, consistent quality – and prices that are steadily dropping but not the absolute lowest due to value-added features. For buyers in India, domestic graphene can be very affordable for basic grades (sometimes even produced in novel low-cost ways), but obtaining top-tier graphene might require patience or importation at added cost. Both regions are converging toward a future where graphene is abundant and inexpensive, but they are coming from different starting points. By late 2020s, one can expect the line between U.S. and Indian graphene prices to blur, especially as global trade and collaboration in this field increase.

Conclusion

Graphene nanoplatelets in 2025 have well and truly arrived as a marketable material, shedding much of their “lab wonder” cost baggage. In both the United States and India, prices have fallen to a point where GNPs are being integrated into real-world products – from car batteries and aerospace composites in the U.S. to conductive inks and strengthened concrete in India. This blog-style report has highlighted that pricing is highly dependent on graphene grade and application, with multi-layer industrial GNPs now available for under $100/kg , while few-layer and specialty graphenes still command higher rates. The U.S. and Indian markets, though different in scale, are both benefiting from global advances that drive costs down.

Key producers and innovators are ensuring supply keeps up with demand, whether it’s a Vermont-based supplier selling research quantities online or a Bangalore startup finding new low-cost production tricks. Importantly, trends indicate the best is yet to come: continued R&D and scaling should make graphene even cheaper and more ubiquitous going into 2026. Forecasts of ~20–30% annual market growth reflect a material that is transitioning from exotic to essential. Within a few years, we may talk about graphene in the same breath as everyday commodities (with prices to match), especially for bulk applications.

For businesses and researchers in 2025, the takeaway is that graphene nanoplatelets are more accessible than ever – both technologically and financially. The USA offers a mature ecosystem for high-quality graphene at reasonable prices, and India is rapidly building an ecosystem for mass, affordable graphene to fuel its industries. Regional differences persist in who the major players are and what drives adoption, but the global trajectory is clear: graphene’s cost curve is bending downward steadily. Those who have been watching and waiting for graphene to “make it” should take note – 2025 is a pivotal year where the graphene nanoplatelet market has enough momentum, competition, and clarity that jumping in no longer feels like a moonshot, but rather a sensible investment in a material with a bright (and increasingly affordable) future.

Sources: The information in this report is based on 2025 data from industry publications, market research, and supplier price lists, including Cheap Tubes/CTI Materials (USA) , a graphene industry blog (USA Graphene) , Grand View Research market analysis , and various news and trade snippets from India highlighting local pricing and initiatives . All pricing and market figures are cited from these contemporary (2024–2025) sources to ensure accuracy.